- BEST PERSONAL FINANCE APP FOR MAC 2015 HOW TO

- BEST PERSONAL FINANCE APP FOR MAC 2015 UPDATE

- BEST PERSONAL FINANCE APP FOR MAC 2015 MANUAL

- BEST PERSONAL FINANCE APP FOR MAC 2015 UPGRADE

- BEST PERSONAL FINANCE APP FOR MAC 2015 SOFTWARE

I opened accounts with several different money management apps. So I decided to try some Quicken alternatives. Unfortunately, Quicken was recently sold and the new ownership group now requires an annual membership fee.

BEST PERSONAL FINANCE APP FOR MAC 2015 UPGRADE

Support for Quicken 2015 ended on April 30, 2018, meaning I would need to upgrade to the latest version to continue using many features. The last version of Quicken I owned was Quicken 2015.

BEST PERSONAL FINANCE APP FOR MAC 2015 SOFTWARE

Intuit, the former Quicken owner, supported the software for 3 years after it was released. The Windows version is more powerful, however, I use a Mac. So you are locked into using Quicken on one computer. Quicken Online was shuttered years ago in favor or (at the time Intuit owned both apps). I also realized there were several downsides to Quicken that hindered the way I wanted to use the app: I wanted something that was fast and easy to use and automatically synced with my financial accounts. Deciding to Replace QuickenĪfter reviewing how I was using Quicken and what I needed to accomplish, I realized I didn’t need all the Quicken features, such as check printing and bill pay. My primary objective was to track my investments (primary) and my spending (secondary). Instead, I used this as an opportunity to reevaluate how I was using Quicken, and whether or not I could find an alternative to Quicken that would meet all my needs. But that is time intensive and can lead to tracking errors.

BEST PERSONAL FINANCE APP FOR MAC 2015 MANUAL

I could have continued making manual entries into my Quick app. Unfortunately, I began having problems syncing all of my financial accounts, including my primary bank account. Quicken is powerful and has many excellent features. Until about two years ago, I used Quicken, one of the most popular desktop money management software programs. Each month I document and review my spending, investments, and credit scores.

BEST PERSONAL FINANCE APP FOR MAC 2015 HOW TO

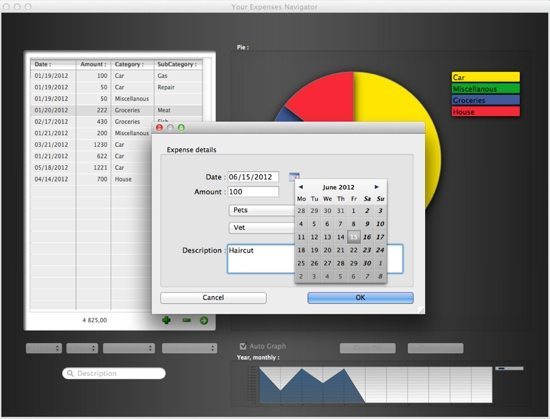

Money Pro will help you stay on top of ALL your money, providing a clear picture of where you are, where to go and how to save more.I’m a big proponent of tracking my money. Any unused portion of a free trial period, if offered, will be forfeited when the user purchases a subscription to that publication, where applicable. Account will be charged for renewal within 24-hours prior to the end of the current period, and identify the cost of the renewal. Payment will be charged to iTunes Account at confirmation of purchase. In all the countries (except the USA), actual charges will be converted to the local currency. iCloud sync for iPhone, iPad, Mac (no subscription)

BEST PERSONAL FINANCE APP FOR MAC 2015 UPDATE

Multiple currencies support & automatic update of exchange rates Print and Export to PDF, QIF, CSV formats Set multiple profiles and track your finances separately for your home budget and small business.

Track expenses with family members/partners and on devices with different platforms. Money Pro Sync (PLUS or GOLD subscription) Customize accounts & categories with over 1,500 built-in icons. Adjust the structure of income/expense categories & subcategories for your needs. Custom periodicity is available for budgeting and bill planning (weekly, monthly, etc.). Trend chart for days/weeks/months/years Search transactions by amount, category, description, payee, etc. Split a transaction into multiple categories when you pay for multiple items at once. Money Pro predicts categories for the transactions being imported. Import history of your transactions (files: OFX, CSV). Automatically calculated available balance and cleared balance. Record transactions and clear them later on (reconcile).

Additional fields for organizing your records: payee, description, check #, class (personal/business travel expenses). Setting transactions as recurring or as one-time only. Unlimited number of accounts in one place (checking, credit card, etc.). Budget rollover limits your spending automatically if you overspent in previous periods. Set budgets to transfer the leftover of the previous budget period to the current one. Monitor visual indicators for budget overspending. Start adding every transaction you have and see the progress of each category and the overall progress. Set different budget limits for every period if needed. Create budgeted entries both for your income and expenses. Quick rescheduling option will help you deal with bills due. A whole system of reminders will alert you of upcoming bills. When you have a transaction, approve it quickly. Schedule recurring bills with custom periodicity. Mark days on the big calendar when your bills are due. Money Pro is the next generation of Money app (over 2 million downloads worldwide). Money Pro works great for home budgeting and even for business use.Įasy sync with iPhone/iPad version. Money Pro® is the one place for bill planning, budgeting, and keeping track of your accounts.

0 kommentar(er)

0 kommentar(er)